The concept of periodic cycles of the world economy, alternating booms and busts lasting 45-60 years, has been actively researched and developed throughout its existence, but a broad consensus in the community of economic scientists has not been achieved regarding its practical applicability.

The main essence of the theory of large cycles of economic conditions (LCC) was first outlined by Kondratiev in the book “The World Economy and Its Conjuncture during and after the War” (Vologda, 1922) and published in expanded form in 1925 in the scientific journal he founded “Questions of Economic Conjuncture” “(Kondratiev, 1925). A translation of the fundamental article “Large Cycles of Conjuncture” was published in the German press in 1926, and in the English press in 1935. Having become familiar with Kondratiev’s work, the outstanding American cyclist economists Wesley Mitchell and Arthur Burns described Kondratiev’s concept as “the most famous of theories long cycles” and devoted a section to it in their famous book “Measuring Business Cycles” (Burns, Mitchell, 1946).

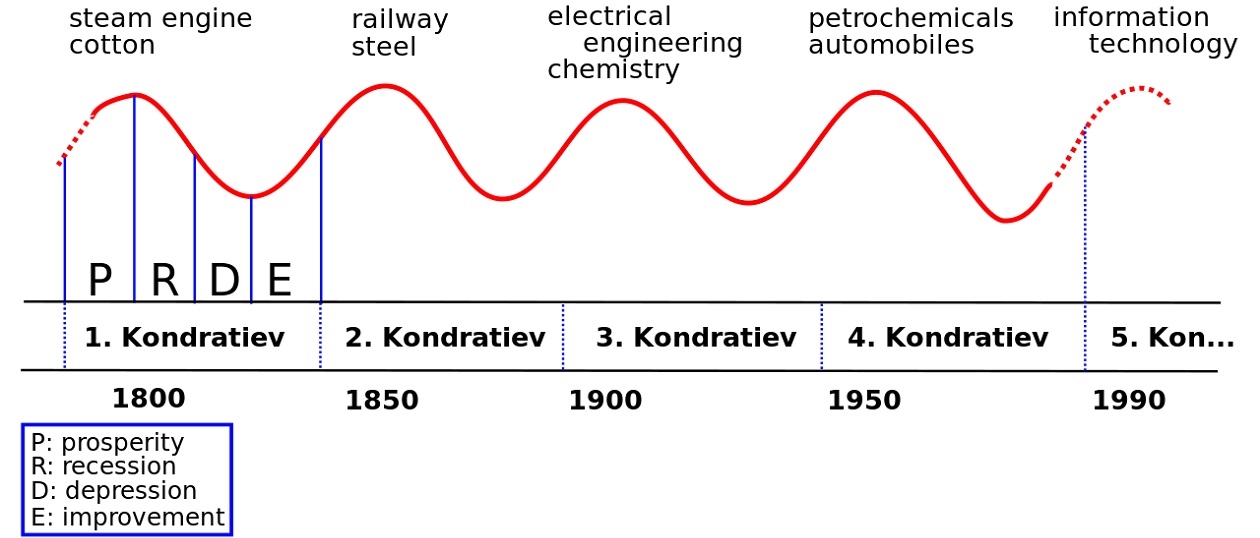

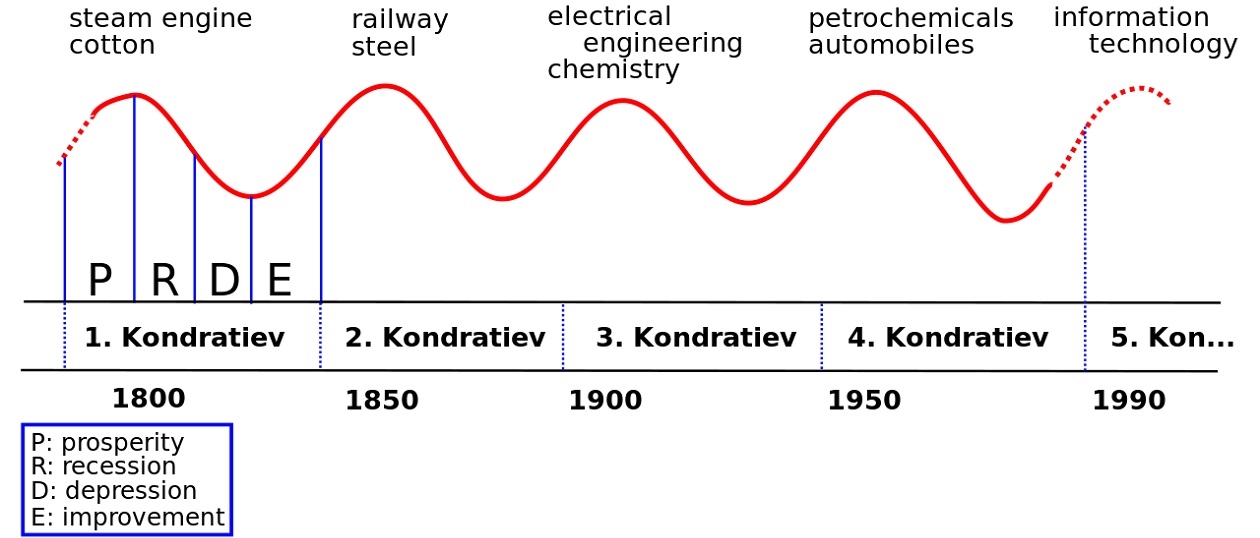

The first wave of research on the BCC ended with the publication of a major thousand-page monograph by the great economist Joseph Schumpeter “Business Cycles” in 1939 in the USA (Schumpeter, 1939). Schumpeter viewed business cycles as a consequence of the innovation process. As early as 1931, he considered the importance of Juglar cycles (Schumpeter, 1931), in the light of the system he developed back in 1907–1912. theory of innovative economic development, which was published in English in 1934 (Schumpeter, 1934). Schumpeter’s theory of innovative development has since gained worldwide fame. It was he who first introduced the term “innovation”. In 1935, Schumpeter proposed a complex theory of three cycles – Kondratieff, Juglar and Kitchin. The superposition of one wave on another, according to Schumpeter, explains the general state of the situation at any given moment. The final economic development curve can be presented as a sum of oscillatory processes with different frequencies relative to the trend development trajectory. The analysis of the dynamics of economic development through the synthesis of three cycles, proposed by Schumpeter, was called the “Great Unification”.

However, by the time Schumpeter’s Business Cycles was published, developed Western countries, including the United States, had already adopted the teachings of John Keynes, which encourages active government intervention in the economy through discretionary fiscal policy to stimulate effective demand and create favorable conditions for private investment. After its extraordinary success in recovering from the deepest economic crisis during the Great Depression of the 1930s, supported by the authority and successful economic policies of the great American President Franklin Roosevelt, Keynesianism became the basis of standard anti-crisis policies for governments in developed countries and found itself in the economic mainstream. Sciences. It is quite natural that, thus, the Schumpeter-Kondratiev theory found itself outside the mainstream of economic science of the 20th century.

In the midst of the next cyclical structural crisis of the world economy, which erupted in 1973, i.e. 44 years after the start of the Great Depression, a book by the outstanding German economist Gerhard Mensch, “Technological Stalemate,” was published in Germany, outlining new facts confirming the Schumpeter-Kondratieff theory. This book was translated into English and published in 1979 in the USA (Mensch, 1979). This marked the beginning of the second wave of BCC research, which continued into the 1980s and was perhaps the most productive. It should be noted that it was Mensch who predicted the onset of the cyclical structural crisis of the 1970s. back in the early 1970s. He also correctly pointed out a feature of the coming crisis — “stagflation”, which consists in the fact that economic stagnation will be accompanied by an increase in prices, and not a decrease in prices, as happened before. He explained that monetary and credit policies in these conditions cannot help overcome the crisis. It is necessary to launch the process of mastering basic innovations of the new technological order.

Indeed, the way out of the structural crisis of the world economy in the 1970s, aggravated by oil shocks, was achieved through a transition to energy and resource-saving technologies based on the achievements of the revolution in semiconductor microelectronics.

However, this time the Schumpeter-Kondratiev theory was not destined to gain a foothold in the mainstream of economic science. The leadership this time was seized by the neoliberals, led by Nobel laureate monetarist Milton Friedman, who was convinced that suppressing inflation should be carried out exclusively through monetary policy measures. And then economic growth will automatically begin. However, the “monetarist experiment” carried out in the US between 1979 and 1982, when inflation rates were in double digits, resulted in real GDP growth stalling and the unemployment rate rising from 6% to its peak of 10.5% at the end of 1982 True, at the same time the rate of inflation growth fell sharply.

Of particular note is the outstanding work of the Japanese scientist Masaaki Hirooka “Innovative dynamics and economic growth. Nonlinear Perspectives,” published in Japan in 2002 and in English in 2006. (Hirooka, 2006), in which, one might say, all the i’s are dotted. In his fundamental monograph, M. Hirooka built a coherent theory of innovative and technological development of a modern market economy. First of all, based on a nonlinear analysis of a huge array of empirical data characterizing the dynamics of various technological innovations throughout the industrial era, he proved the existence of an indisputable correlation between the diffusion of innovations and the BCC, and also established that the diffusion of innovations, thanks to the mechanism of self-organization, selectively collects a powerful cluster of innovations along lifting the BCC. Thus, he finally established the position that the diffusion of innovations is completely synchronized with the increasing stage of the BCC and reaches saturation in the region of the highest peak of the cycle.

Another outstanding achievement of M. Hirooki was the development of a new innovation paradigm, consisting of a cascade of three related nonlinear trajectories: technological development itself; creation and development of innovative products and, finally, diffusion of innovations into markets. It turned out that all trajectories are described by a logistic curve and have strictly defined delays from each other, i.e. represent a fairly rigid cascade structure.

Moreover, M. Hirooka was the first to identify and study the trajectory of technological development and show that it is also described by a logistic curve. It is also remarkable that the new innovation paradigm allows us to predict the dynamics of the emergence and spread of innovations in markets even at the stage of technological development.

Taking advantage of this circumstance, M. Hirooka analyzed in detail the development trajectories of the most promising technologies of the future, which can form a cluster of basic technologies for the upcoming sixth Kondratieff cycle: multimedia, nanotechnology, biotechnology, genetic engineering and regeneration of human organs, superconductors and quantum computers, etc. . He built trajectories for the development of corresponding innovative products for all these technologies and found that all of them are on the verge of commercialization and reach maturity in 2010–2015, which means that it is in these years that the diffusion of innovative products into markets will begin, which will launch the upcoming sixth Kondratieff cycle with a rise around 2020–2040. So, M. Hirooka filled in two missing links in a comprehensive substantiation of the mechanisms of formation of the BCC and completely filled the gap that remained in the evidentiary basis of the Schumpeter-Kondratieff theory. Naturally, his ideas require further confirmation and polishing. However, as a first approximation, it can be argued that the innovation-cyclical theory of economic development of Schumpeter-Kondratiev is now strictly substantiated.

The fourth wave of research on the Schumpeter-Kondratieff theory was created by the powerful impulse of the next global cyclical crisis, which erupted in 2008–2009, as always, unexpectedly for governments and representatives of the mainstream of economic science advising them. As a result, many works appeared that refined and developed this theory.